135 000 or more if your tax filing status is single.

Back door roth ira contribution 2018.

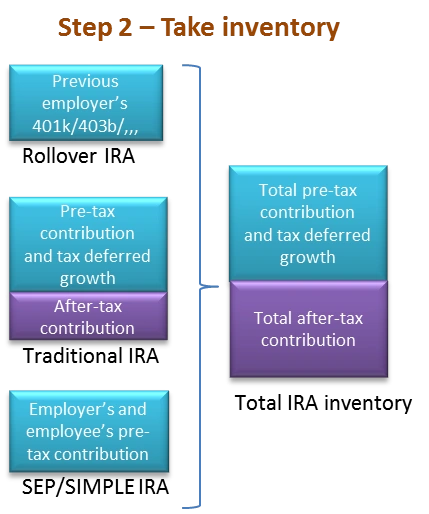

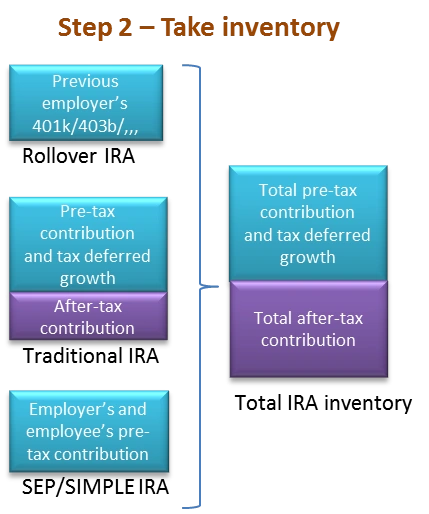

You can use a back door roth ira by completing these steps.

But if you earn more than the cutoff and you want to make a back door roth contribution it s important to consider the total.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

In general if you have earned income from work then you can make an ira contribution.

The two steps to a backdoor roth ira contribution.

If you re one of these people you can still use a roth ira account by using what s known as a back door roth ira.

Why a roth conversion or backdoor roth ira is a good idea in 2018 september 19 2018 by kathleen coxwell doing a roth conversion also known as a backdoor roth ira is perhaps even more appealing in 2018 than ever before.

Roth ira contribution limits remain 5 500 in 2018 the same as they were in 2017 and those who are 50 or older can contribute an additional 1 000 to make their total 6 500.

Those over 50 can contribute 6 500 7 000 in 2019.

A roth ira conversion made in 2017 may be recharacterized as a contribution to a traditional ira if the recharacterization is made by october 15 2018.

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

The backdoor roth ira contribution is a strategy and not a product or.

Taxpayers with higher incomes don t qualify to contribute to a roth ira directly.

You have until april 15 2019 to contribute to a roth ira for 2018.

For 2020 you can contribute up to 6 000 with those 50 or older getting to.

If you are under 50 you can contribute 5 500 per year 6 000 in 2019.

Step one is to make a contribution to a traditional ira.

A roth ira conversion made on or after january 1 2018 cannot be recharacterized.